Prospera is applying to continue federally for the purposes of immediately merging with Coast Capital and Sunshine Coast credit unions. Find out more here.

For full details about changes in deposit insurance, see the Notice Pursuant to the Disclosure on Continuance Regulations.

For full details about changes in deposit insurance, see the Notice Pursuant to the Disclosure on Continuance Regulations.

Skip to main content

-

PERSONAL

Accounts

Accounts- Compare daily accounts

- Unlimited

- Basic

- Unlimited Senior

- Unlimited Young Adult

- Personal US Account

- Compare savings accounts

- Personal high growth savings account

- Personal savings account

- Additional services

- OFX money transfers

- Money and wire transfers

- Safety deposit boxes

- Cheque ordering

- Foreign currency

- eStatements

- Ways to bank

Credit Cards

Mortgages

Loans & Lines of Credit

Loans & Lines of CreditInvesting

Investing- Ways to invest

- Compare term deposits

- Non-redeemable

- Cashable

- Rate climber

- Re-investable

- Non-redeemable US

- Mutual funds

- Compare registered plans

- RRSP

- TFSA

- RESP

- RDSP

- RRIF

- FHSA

- Online investing tools

- Offers

- The 30k giveaway

- Promotional term deposit rates

- $0 Investment transfer fee

- 5% cashback on self-directed investing

-

BUSINESS

Business homepage

Accounts

Accounts- Daily accounts

- Compare daily accounts

- Business pay-as-you-go account

- Business e-chequing account

- Business plan 35 account

- Business plan 75 account

- Local community account

- Business US account

- Compare savings accounts

- Business high growth savings account

- Business savings account

- Ways to bank

- Business Online Banking

- Advanced Business Online

Credit Cards

Cash Management

Cash ManagementBorrowing

Advisors & Resources

-

WEALTH

Wealth homepage

Our Approach

Work With An Advisor

- Work with an advisor

- Lower Mainland

- Investment specialists

- Investment advisors

- Fraser Valley

- Investment specialists

- Investment advisors

- Okanagan

- Investment specialists

- Investment advisors

Personal investing

Insurance

- Compare insurance

- Annuities

- Critical illness insurance

- Disability insurance

- Life insurance

- Long-term care insurance

- Work with an insurance expert

- Insurance specialists

-

COMMUNITY

COMMUNITYDoing good

Giving back

Events and programs

Grants, sponsorships and donations

Education bursaries and grants

Prospera Foundation charitable grants

PERSONAL

Accounts

Credit Cards

Mortgages

Loans & Lines of credit

Investing

Credit card advice

BUSINESS

Accounts

Credit Cards

Cash Management

Borrowing

Advisors & Resources

Credit card advice

WEALTH

How we help

Work with an advisor

Personal investing

Insurance

Personalized financial advice

Lower Mainland

Fraser Valley

Investment goals

Investment advice

Investment calculators

Work with an insurance expert

COMMUNITY

In the community

Kids

Financial literacy

The important information you and your children need to know. Early learning can lead them down a path towards financial success.

The best way to teach financial literacy is to start talking about it.

Talk about money, talk about yourself - what you're doing and ask questions about what others are doing. Let's stop treating money as a taboo topic and start a money dialogue with kids early.

What can you do as the adult:

- Evaluating your own financial habits

- Establishing core values through a family economy

- Creating family savings goals

- Using your kid's allowance as a teaching tool

- Describing how money works in a digital world

- Teaching kids how to budget

- Teaching the importance of moderation

Ways you can teach financial literacy to kids:

- Play games that involve money

- Discuss wants vs. needs

- Make a wish list with your child

- Teach while you shop

- Give an allowance

- Split money into categories

- Give them a payday

- Create a budget from their allowance

Click here to download our printable goals sheet, specificaly designed with children in mind.

What does saving, spending and donating really mean?

Level 1 - recommended for ages 4 to 7

Start teaching your child about the basics of saving, spending and donating with these fun tips for kids.

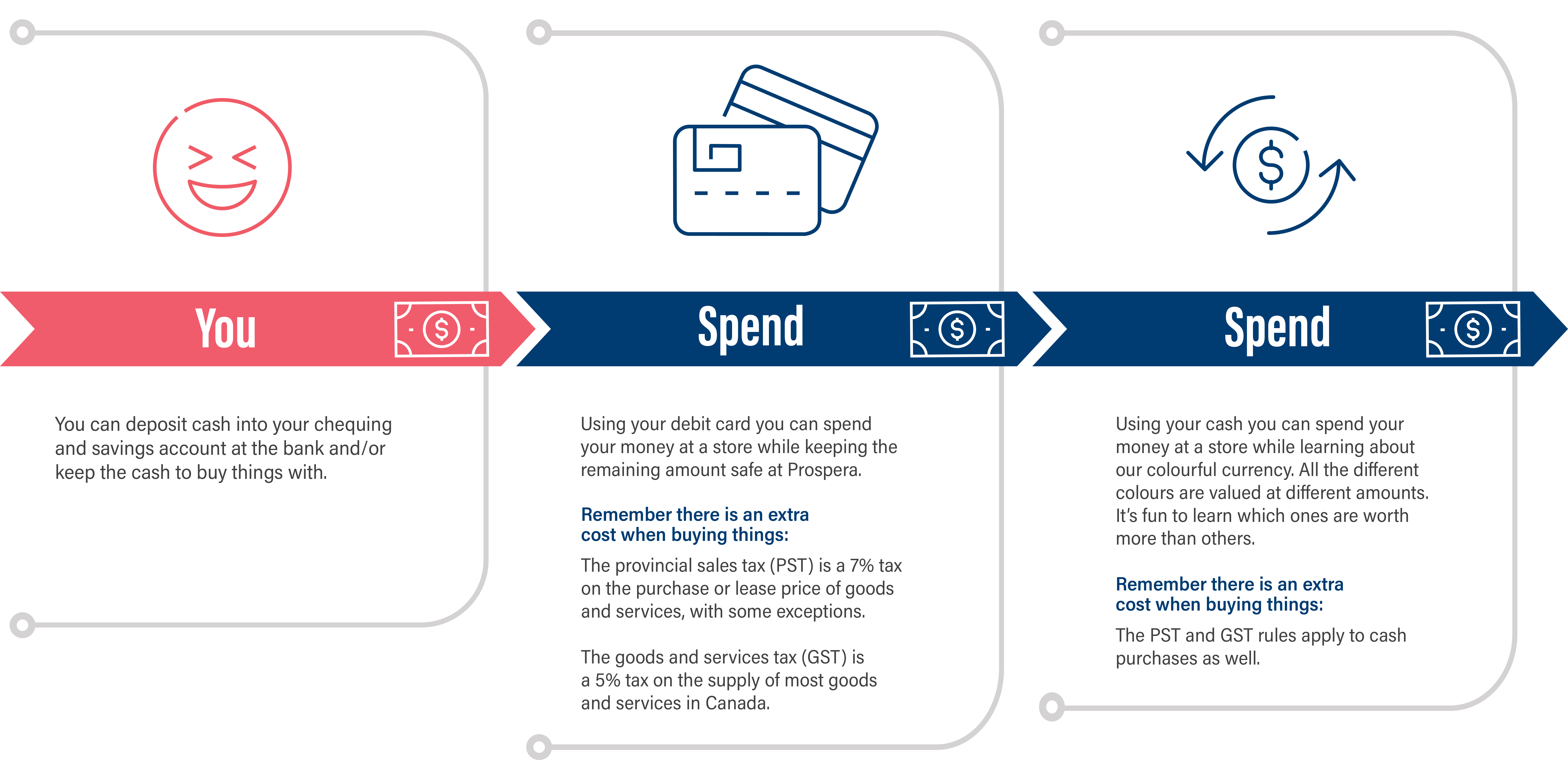

How is money spent?

Level 2 - recommended for ages 8 to 11

You've got some money in your pocket, and you want to spend it on something fun. But how does that happen? We'll break it down for you here.

Empower yourself to become financially savvy and independent

Level 3 - recommended for ages 12 to 18

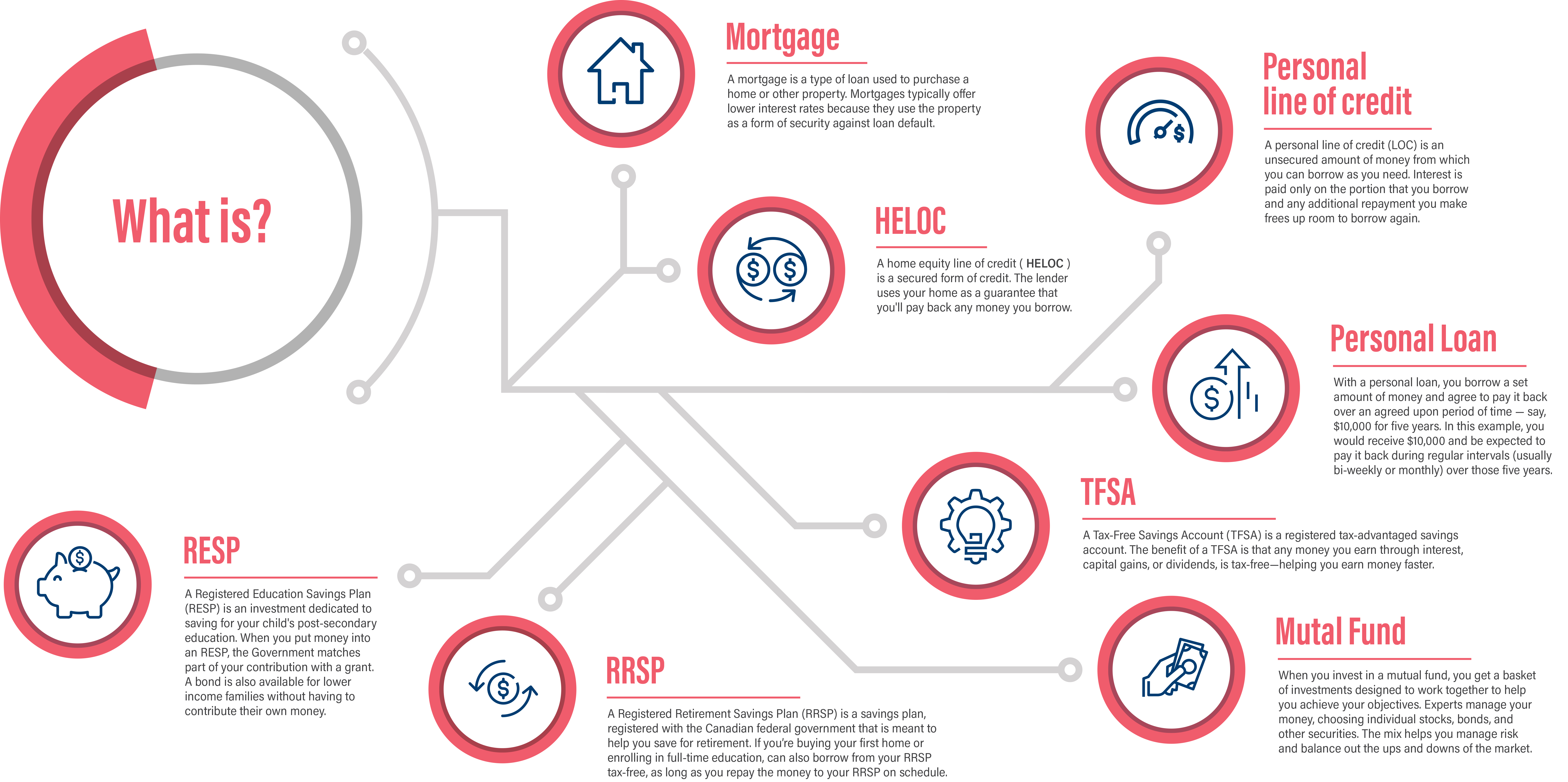

Our goal is to give you the tools you need to understand the most common financial lingo and make informed decisions about your money.

We've put together a graphic with some of the most common financial terms, so that when you hear them in conversation, you'll know exactly what's going on.

What are the 5 principles of financial literacy?

Money affords us choice, is part of everyday life, and can be used as a tool to help with your success in life. Learn the five principles below to empower yourself to be make educated decisions to benefit your future.

1. Earning

Talk about how money is earned

2. Saving and investing

Discuss as a family:

- Family savings goals (ex. vacation, boat, camper)

- How to budget and save for better things

- Go shopping to look and not buy

- What free things can we do instead of spending money

- Piggy bank to help create saving habits

- Use a ticket system for kids to cash in to get a bigger item (ex. bike)

3. Spending

Spending can be fun but teaching them healthy habits is a life goal that can set your child up for success:

- When the weekend comes up, decide as a family is it more important to everyone to save for something bigger or to go out and do something fun

- When grocery shopping with your kids, add up with them the amount and tell them the budget. Make it a game so they learn how much things cost

4. Borrowing

Borrowing vs buying:

- With the tickets they earn they could use them to save, spend or borrow additional tickets to pay back later

- Remind them of the larger goal that they wanted to ensure it's what they really want

5. Protecting

Talk with your kids about:

- Protecting your money and/or tickets

- Teach how they can protect them by opening a savings account or storing the money / tickets in a safe place

Prospera Foundation is proud to partner with JA British Columbia, a not-for-profit organization that provides young people with free, hands-on and immersive education in work readiness, financial health and entrepreneurship.

Click here to join the JA Campus and get access to dozens of free financial literacy, business and career readiness programs for students in grades 3 to 12.

More inspiration

How to reach us

Call our Member Service Centre

Contact tech support

Available 24/7

1 888 884 4430

Send a support email