Prospera is applying to continue federally for the purposes of immediately merging with Coast Capital and Sunshine Coast credit unions. Find out more here.

For full details about changes in deposit insurance, see the Notice Pursuant to the Disclosure on Continuance Regulations.

For full details about changes in deposit insurance, see the Notice Pursuant to the Disclosure on Continuance Regulations.

Skip to main content

-

PERSONAL

Accounts

Accounts- Compare chequing accounts

- Unlimited

- Basic

- Unlimited Senior

- Unlimited Young Adult

- Personal US Account

- Compare savings accounts

- Personal high growth savings account

- Personal savings account

- Additional services

- OFX money transfers

- Money and wire transfers

- Safety deposit boxes

- Cheque ordering

- Foreign currency

- eStatements

- Ways to bank

Credit Cards

Credit Cards- Compare all credit cards

- Premium cash rewards

- Premium rewards

- No fee & rewards

- Low fee & low interest

- Low interest & rewards

- US Dollar

- Offers

- Up to $360 in value with Cash Back Visa Infinite

- Young adult $100 credit offer

- 0% credit card balance transfer

- Explore all credit card offers

- Credit card advice

- New to Canada

Mortgages

Loans & Lines of Credit

Loans & Lines of CreditInvesting

Investing- Ways to invest

- Compare term deposits

- Non-redeemable

- Cashable

- Rate climber

- Re-investable

- Non-redeemable US

- Mutual funds

- Compare registered plans

- RRSP

- TFSA

- RESP

- RDSP

- RRIF

- FHSA

- Online investing tools

- Offers

- Get up to $3,000 with new investments

- Get up to $350 when you automate your investing

- 3.4% promotional term deposit

- $0 Investment transfer fee

-

BUSINESS

Business homepage

Accounts

Accounts- Chequing accounts

- Compare daily accounts

- Business pay-as-you-go account

- Business e-chequing account

- Business plan 35 account

- Business plan 75 account

- Local community account

- Business US account

- Compare savings accounts

- Business high growth savings account

- Business savings account

- Ways to bank

- Business Online Banking

- Advanced Business Online

Credit Cards

Cash Management

Cash ManagementBorrowing

Advisors & Resources

-

WEALTH

Wealth homepage

Our Approach

Work With An Advisor

- Work with an advisor

- Lower Mainland

- Investment specialists

- Investment advisors

- Fraser Valley

- Investment specialists

- Investment advisors

- Okanagan

- Investment specialists

- Investment advisors

Personal investing

Insurance

- Compare insurance

- Annuities

- Critical illness insurance

- Disability insurance

- Life insurance

- Long-term care insurance

- Work with an insurance expert

- Insurance specialists

-

COMMUNITY

COMMUNITYDoing good

Giving back

Events and programs

Grants, sponsorships and donations

Education bursaries and grants

Prospera Foundation charitable grants

Up to $360 in value with Cash Back Visa Infinite

PERSONAL

Accounts

Credit Cards

Mortgages

Loans & Lines of credit

Investing

Credit card advice

BUSINESS

Accounts

Credit Cards

Cash Management

Borrowing

Advisors & Resources

Credit card advice

WEALTH

How we help

Work with an advisor

Personal investing

Insurance

Personalized financial advice

Lower Mainland

Fraser Valley

Investment goals

Investment advice

Investment calculators

Work with an insurance expert

COMMUNITY

In the community

Mortgages

Compare our mortgage rates

You've found your dream home. Let us help with the rest.

Your dream home is waiting. Whether you’re a first-time buyer, ready to downsize or looking to refinance, we've got you covered with rates and options to suit your unique situation.

Check out our featured rates:

All available mortgage rates:

| Featured Mortgages | Rate |

|---|---|

| 5-Year Variable Rate Closed - Insured |

3.65%

|

| 5-Year Fixed Rate Closed - Insured |

3.89%

|

| Fixed Rate Mortgages | Rate |

|---|---|

| 1-Year Open |

7.20%

|

| 1-Year Closed |

4.79%

|

| 2-Year Closed |

4.39%

|

| 3-Year Closed |

4.19%

|

| 4-Year Closed |

4.29%

|

| 5-Year Closed |

4.19%

|

| 5-Year Closed - Insured |

3.89%

|

| 7-Year Closed |

4.75%

|

| 10-Year Closed |

5.10%

|

| Variable Rate Mortgages | Rate |

|---|---|

| 5 Year Closed |

3.75%

|

| 5 Year Closed - Insured |

3.65%

|

Overwhelmed by the numbers? Not sure what it all means? Not a problem. Our local mortgage experts are here to provide more information and guide you through the decision-making process.

Key mortgage terms

Fixed rate mortgage

A Fixed-Rate Mortgage is a type of home loan that has a single interest rate for the entire term, or length, of the loan.

Variable rate mortgage

A Variable Rate Mortgage is a type of home loan where the interest rate is not fixed, but instead, it adjusts at a level above a specific benchmark or reference rate throughout the loan’s term.

Open and closed mortgage rates

Open mortgage rates: These are flexible mortgage rates that allow you to repay any part of your mortgage at any time without a prepayment charge, but often have higher interest rates.

Closed mortgage rates: These are fixed-term mortgage rates with lower interest rates, but they may include prepayment penalties if you pay more than the agreed amount before the term ends.

Closed mortgage rates: These are fixed-term mortgage rates with lower interest rates, but they may include prepayment penalties if you pay more than the agreed amount before the term ends.

Open and closed mortgage rates

Open term mortgage: This is a flexible mortgage that allows you to borrow more money from the lender at a later time.

Closed term mortgage: This is a fixed-term mortgage where you cannot increase the principal amount and must repay it by a certain date.

Closed term mortgage: This is a fixed-term mortgage where you cannot increase the principal amount and must repay it by a certain date.

Insured vs uninsured mortgage

Insured mortgage: This is a mortgage that is protected by mortgage default insurance, typically required when the down payment is less than 20% of the home’s purchase price.

Uninsured mortgage: This is a mortgage that does not have mortgage default insurance, typically applicable when the down payment is more than 20% of the home’s purchase price. Since these home buyers have a larger proportion of equity in their home, they are not required to take out mortgage default insurance.

Uninsured mortgage: This is a mortgage that does not have mortgage default insurance, typically applicable when the down payment is more than 20% of the home’s purchase price. Since these home buyers have a larger proportion of equity in their home, they are not required to take out mortgage default insurance.

Mortgage amortization

Mortgage amortization: It’s the process of paying off your home loan in regular monthly payments over a fixed period of time, where initially most of the payment goes towards interest and later, most of it reduces the principal debt.

Ready to get started?

Try our residential mortgage calculator

See how the different rates can affect your payments and what fits into your budget.Get pre-approved online

Work with a mortgage expert

Whether you're new to the home buying process or a seasoned professional, our team of experienced mortgage professionals can talk you through the process and get you the best rates available.Book an appointment Fill out our contact form 1 888 440 4480

Additional mortgage resources

First-time home buyer’s toolkit

Tips for when you purchase a home

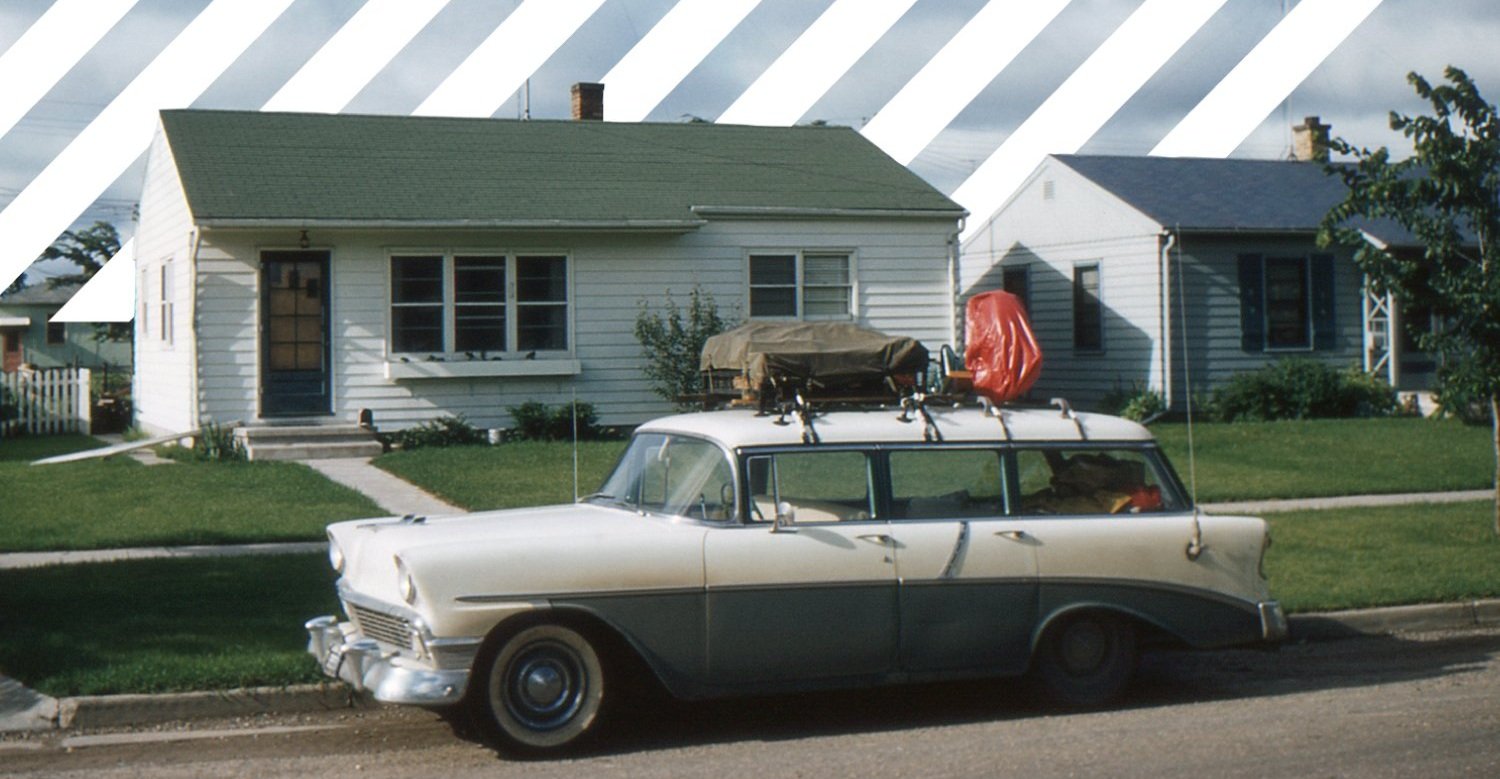

The B.C. housing market over the decades

View additional housing articles in our Online Advice Centre.