- Tier 1: Receive 10,000 points ($100 value) after completing your 1st purchase within 40 days of the Account Open Date†

- Tier 2: Receive 30,000 ($300 value) points upon reaching the “Qualifying Transaction Amount” of $5,000 within 100 days of the Account Open Date†

- Annual Fee Rebate: Enjoy a rebate on the annual fee in your first year ($120 value)†

Prospera is applying to continue federally for the purposes of immediately merging with Coast Capital and Sunshine Coast credit unions. Find out more here.

For full details about changes in deposit insurance, see the Notice Pursuant to the Disclosure on Continuance Regulations.

For full details about changes in deposit insurance, see the Notice Pursuant to the Disclosure on Continuance Regulations.

Skip to main content

-

PERSONAL

Accounts

Accounts- Compare daily accounts

- Unlimited

- Basic

- Unlimited Senior

- Unlimited Young Adult

- Personal US Account

- Compare savings accounts

- Personal high growth savings account

- Personal savings account

- Additional services

- OFX money transfers

- Money and wire transfers

- Safety deposit boxes

- Cheque ordering

- Foreign currency

- eStatements

- Ways to bank

Credit Cards

Credit Cards- Compare all credit cards

- Premium cash rewards

- Premium rewards

- No fee & rewards

- Low fee & low interest

- Low interest & rewards

- US Dollar

- Offers

- Up to $520 in rewards and no annual fee

- Young adult $50 credit offer

- 0% credit card balance transfer

- Explore all credit card offers

- Credit card advice

- New to Canada

Mortgages

Loans & Lines of Credit

Loans & Lines of CreditInvesting

Investing- Ways to invest

- Compare term deposits

- Non-redeemable

- Cashable

- Rate climber

- Re-investable

- Non-redeemable US

- Mutual funds

- Compare registered plans

- RRSP

- TFSA

- RESP

- RDSP

- RRIF

- FHSA

- Online investing tools

- Offers

- The 30k giveaway

- Promotional term deposit rates

- $0 Investment transfer fee

- 5% cashback on self-directed investing

-

BUSINESS

Business homepage

Accounts

Accounts- Daily accounts

- Compare daily accounts

- Business pay-as-you-go account

- Business e-chequing account

- Business plan 35 account

- Business plan 75 account

- Local community account

- Business US account

- Compare savings accounts

- Business high growth savings account

- Business savings account

- Ways to bank

- Business Online Banking

- Advanced Business Online

Credit Cards

Cash Management

Cash ManagementBorrowing

Advisors & Resources

-

WEALTH

Wealth homepage

Our Approach

Work With An Advisor

- Work with an advisor

- Lower Mainland

- Investment specialists

- Investment advisors

- Fraser Valley

- Investment specialists

- Investment advisors

- Okanagan

- Investment specialists

- Investment advisors

Personal investing

Insurance

- Compare insurance

- Annuities

- Critical illness insurance

- Disability insurance

- Life insurance

- Long-term care insurance

- Work with an insurance expert

- Insurance specialists

-

COMMUNITY

COMMUNITYDoing good

Giving back

Events and programs

Grants, sponsorships and donations

Education bursaries and grants

Prospera Foundation charitable grants

PERSONAL

Accounts

Credit Cards

Mortgages

Loans & Lines of credit

Investing

Credit card advice

BUSINESS

Accounts

Credit Cards

Cash Management

Borrowing

Advisors & Resources

WEALTH

How we help

Work with an advisor

Personal investing

Insurance

Personalized financial advice

Lower Mainland

Fraser Valley

Investment goals

Investment advice

Investment calculators

Work with an insurance expert

COMMUNITY

In the community

Max rewards. No annual fee.

Get up to $520 in total value† with a Prospera Visa Infinite* or Cash Back Visa Infinite* card.

|

- PERSONAL

- Credit Cards

- Offers

- Up to $520 in rewards and no annual fee

More value. More rewards. Less cost.

For a limited time, apply for a premium credit card that offers exclusive benefits††, flexible rewards1, and no annual fee in your first year†.

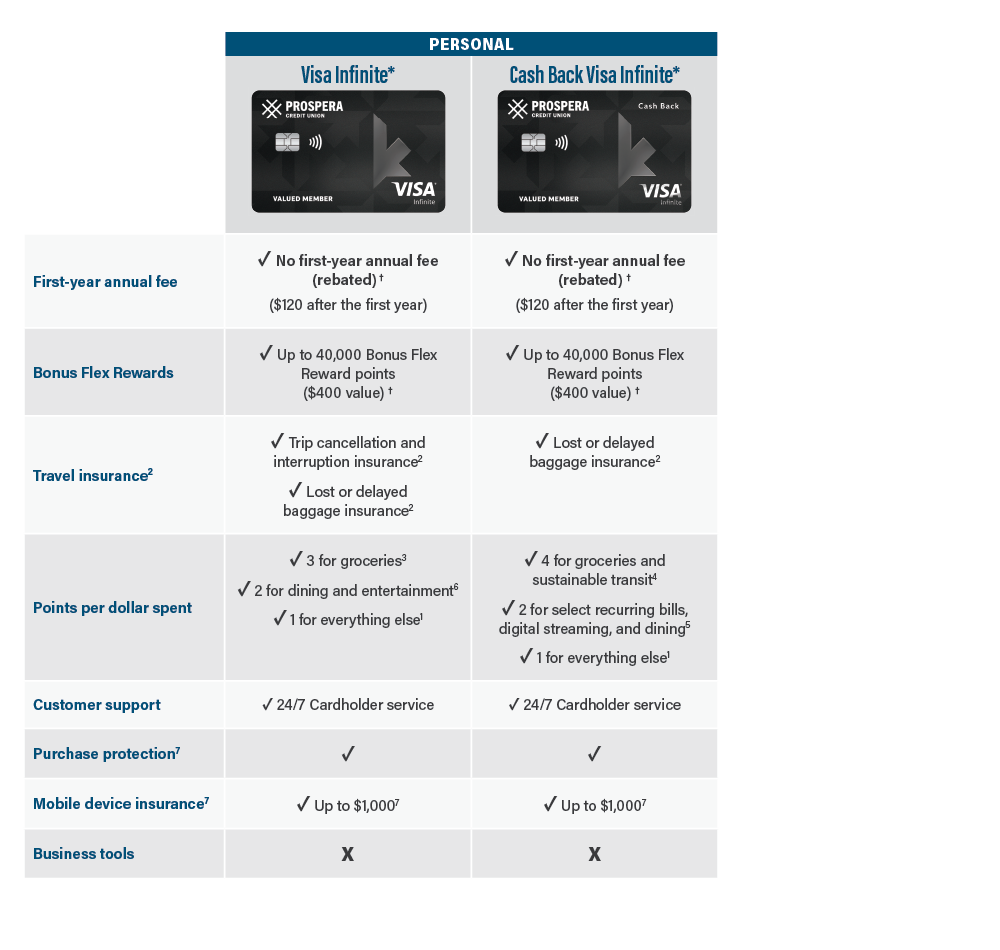

Choose the right card for you

Unlock the Visa Infinite* Advantage

Along with global acceptance and the classic convenience of Visa, your Visa Infinite* card gives you exclusive access to premium lifestyle benefits††:✔ Access to 900+ luxury hotels with daily breakfast, upgrades & VIP perks

✔ Invitations to chef-curated dining and wine events across Canada

✔ Discounts and privileges at top golf destinations worldwide

✔ Platinum status with select hotel chains, including room upgrades and late checkout

✔ 24/7 concierge service to assist with travel, dining, and personal requests

Apply now and get up to $520 in value, including no annual fee in your first year †.

Frequently asked questions

How do I earn up to $520 in welcome incentives

Why should I get a Visa Infinite* or Cash Back Visa Infinite* credit card?

Both cards offer premium benefits†† — but they’re tailored to different goals.

- If you like to travel, redeem points1, and enjoy exclusive perks††, the Visa Infinite is a great fit.

- If you prefer cash back on your everyday purchases, the Cash Back Visa Infinite helps you earn while you spend8.

How do I apply?

There are three convenient ways to apply:

- Apply online: Submit your application online in just a few minutes. Apply for the Visa Infinite* card here or the Cash Back Visa Infinite* card here.

- Apply over the phone: Call our Member Service Centre at 1-888-440-4480 and we’ll walk you through the application process.

- Apply in person: Book an appointment at your local Prospera branch to meet with an advisor and complete your application.

How do I earn points on everyday purchases?

With the Visa Infinite* and Visa Infinite* Cash Back credit cards, you earn reward points every time you use your card1 — whether you’re buying groceries, booking travel, or shopping online.

Points accumulate automatically and can be redeemed for travel, gift cards, merchandise, or statement credits**.

How to reach us

Call our Member Service Centre

Contact tech support

Available 24/7

1 888 884 4430

Send a support email

Send us an email

Meet online or in person

Legal

† Offer terms and conditions apply. Click here for full details.

††Terms & conditions apply. Visit https://www.collabriacreditcards.ca/affiliate_prospera-credit-union/benefits/visa-benefits/visa-infinite--exclusive-benefits/default.aspx for more details.

**Terms & conditions apply. Visit https://reward-headquarters.com/groupCollabriaNational/home for more details.

1 Reward points are earned on net purchases only. Any Cash-like Transactions including Cash Advances, and interest charges, fees, payments, credit or debit adjustments and any amount other than Purchases that may be charged to your Account with your Card or Convenience Cheques, do not qualify for Points. For more information visit collabriacreditcards.ca/rewards

2 Insurance coverage is underwritten by Desjardins Financial Security Life Assurance Company. Details of insurance coverage, including number of days of coverage, definitions, benefits, limitations and exclusions are in the Travel Insurance Contract. Please visit collabriacreditcards.ca/insurance.aspx for complete details. Insurance coverage is subject to change.

3 If annual GROCERY purchase volume on a Visa Infinite Card exceeds $20,000 in a calendar year, the points earned for all new net purchases after this amount is reached are those associated with the ‘All other purchases rate’ category until January 1 of the following calendar year.

4 If the combined annual GROCERY and SUSTAINABLE TRANSIT purchase volume on a Cash Back Visa Infinite card exceeds $20,000 in a calendar year, the points earned for all net new purchases after this amount is reached will be associated with the ‘All other purchases’ rate category until January 1 of the following calendar year.

5 If the combined annual select RECURRING BILLS, DIGITAL STREAMING AND DINING purchase volume on a Cash Back Visa Infinite card exceeds $20,000 in a calendar year, the points earned for all net new purchases after this amount is reached will be associated with the ‘All other purchases’ rate category until January 1 of the following calendar year. 6 If annual combined ENTERTAINMENT and DINING purchase volume on a Visa Infinite Card exceeds $15,000 in a calendar year, the points earned for all new net purchases after this amount is reached are those associated with the ‘All other purchases rate’ category until January 1 of the following calendar year.

7 Insurance coverage is underwritten by American Bankers Insurance Company of Florida (ABIC). ABIC, its subsidiaries, and affiliates carry on business in Canada under the trade name of Assurant®. ®Assurant is a registered trademark of Assurant, Inc. Details of insurance coverage, including definitions, benefits, limitations and exclusions, are in the Certificate of Insurance. The Certificate of Insurance is available online at collabriacreditcards.ca/insurance. Insurance coverage is subject to change.

8 The base value of one reward point is equal to one cent (a penny per point). The cash equivalent shown for illustration purposes only is based upon the redemption of these points as a statement credit. The valuation is for cash equivalent only; the value of redeeming for merchandise and travel may vary.

* The Collabria Visa Card is issued by Collabria Financial Services Inc. pursuant to a license from Visa. Visa is a trademark of Visa Int. and is used under license.

Collabria Financial Services Inc. (“Collabria”) is an independent entity from your credit union with no ownership interest in the other. If you choose to obtain Collabria credit card services through a referral from your credit union, it will receive compensation from Collabria.

††Terms & conditions apply. Visit https://www.collabriacreditcards.ca/affiliate_prospera-credit-union/benefits/visa-benefits/visa-infinite--exclusive-benefits/default.aspx for more details.

**Terms & conditions apply. Visit https://reward-headquarters.com/groupCollabriaNational/home for more details.

1 Reward points are earned on net purchases only. Any Cash-like Transactions including Cash Advances, and interest charges, fees, payments, credit or debit adjustments and any amount other than Purchases that may be charged to your Account with your Card or Convenience Cheques, do not qualify for Points. For more information visit collabriacreditcards.ca/rewards

2 Insurance coverage is underwritten by Desjardins Financial Security Life Assurance Company. Details of insurance coverage, including number of days of coverage, definitions, benefits, limitations and exclusions are in the Travel Insurance Contract. Please visit collabriacreditcards.ca/insurance.aspx for complete details. Insurance coverage is subject to change.

3 If annual GROCERY purchase volume on a Visa Infinite Card exceeds $20,000 in a calendar year, the points earned for all new net purchases after this amount is reached are those associated with the ‘All other purchases rate’ category until January 1 of the following calendar year.

4 If the combined annual GROCERY and SUSTAINABLE TRANSIT purchase volume on a Cash Back Visa Infinite card exceeds $20,000 in a calendar year, the points earned for all net new purchases after this amount is reached will be associated with the ‘All other purchases’ rate category until January 1 of the following calendar year.

5 If the combined annual select RECURRING BILLS, DIGITAL STREAMING AND DINING purchase volume on a Cash Back Visa Infinite card exceeds $20,000 in a calendar year, the points earned for all net new purchases after this amount is reached will be associated with the ‘All other purchases’ rate category until January 1 of the following calendar year. 6 If annual combined ENTERTAINMENT and DINING purchase volume on a Visa Infinite Card exceeds $15,000 in a calendar year, the points earned for all new net purchases after this amount is reached are those associated with the ‘All other purchases rate’ category until January 1 of the following calendar year.

7 Insurance coverage is underwritten by American Bankers Insurance Company of Florida (ABIC). ABIC, its subsidiaries, and affiliates carry on business in Canada under the trade name of Assurant®. ®Assurant is a registered trademark of Assurant, Inc. Details of insurance coverage, including definitions, benefits, limitations and exclusions, are in the Certificate of Insurance. The Certificate of Insurance is available online at collabriacreditcards.ca/insurance. Insurance coverage is subject to change.

8 The base value of one reward point is equal to one cent (a penny per point). The cash equivalent shown for illustration purposes only is based upon the redemption of these points as a statement credit. The valuation is for cash equivalent only; the value of redeeming for merchandise and travel may vary.

* The Collabria Visa Card is issued by Collabria Financial Services Inc. pursuant to a license from Visa. Visa is a trademark of Visa Int. and is used under license.

Collabria Financial Services Inc. (“Collabria”) is an independent entity from your credit union with no ownership interest in the other. If you choose to obtain Collabria credit card services through a referral from your credit union, it will receive compensation from Collabria.